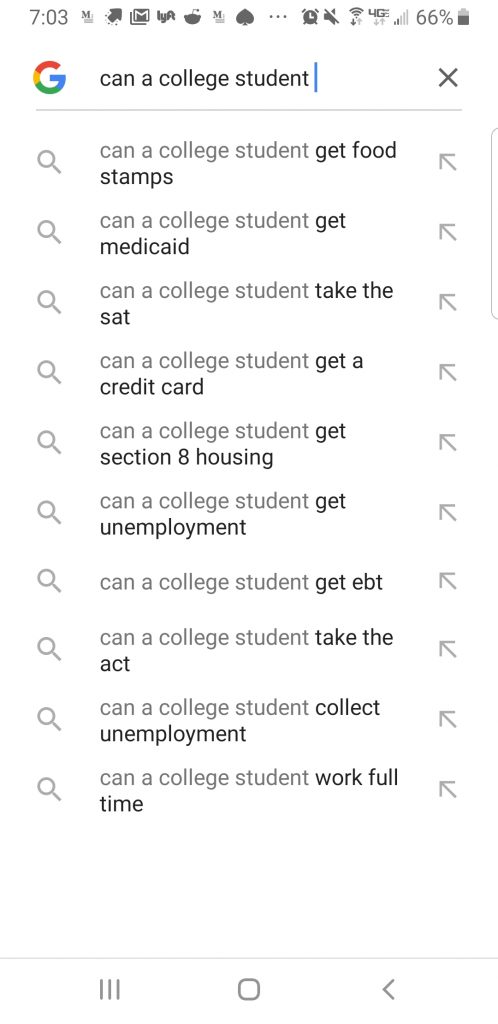

6 Google Search Predictions Show Just How Dire College Student Financial Situations Have Become

I don’t remember what I was searching for, but, I was recently met with the above autocomplete suggestions. The way I understand it, Google might actually be making these appear based on who I am and what I search. That being the case, maybe other people see differently. Either way, each Google Search Prediction here is kind of unsettling. Let’s go down the list and take a look at each of them one at a time.

Search Prediction 1: Can A College Student Get Food Stamps

Most schools are supposed to have some sort of affordable dining options on-campus. Mine were a little bit more expensive, so I found myself occasionally filling in gaps on my menu with PB&J’s and Ramen. While I never had to look into getting food stamps myself, it doesn’t surprise me that a lot of college kids have searched for it.

So, can they?

The short answer is “no,” according to the Food and Nutrition Service Website for the Department of Agriculture. Unless there are very specific circumstances, like getting public assistance benefits under a Title IV-A program. There are other scenarios where a college student can currently qualify, too:

- Take part in a state or federally financed work study program;

- Work at least 20 hours a week;

- Are taking care of a dependent household member under the age of 6;

- Are taking care of a dependent household member over the age of 5 but under 12 and do not have adequate child care to enable them to attend school and work a minimum of 20 hours, or to take part in a state or federally financed work study program; or

- Are assigned to or placed in a college or certain other schools through:

- A program under the Workforce Investment Act of 1998;

- A program under Section 236 of the Trade Act of 1974;

- An employment and training program under the Food Stamp Act; or

- An employment and training program operated by a state or local government.

Search Prediction 2: Can A College Student Get Medicaid

It depends. If you are under a certain level of income and living in one of the states that has expanded Medicaid coverage, there’s a chance. You also can’t be listed as a dependent on your family’s tax return. Most often, though, there will be affordable health coverage options for you in school.

Prediction 3: Can A College Student Get A Credit Card

Yes! I think I had my first credit card when I was something like 16 or 17. That being said, I saw (and still see) plenty of people of all ages abuse credit cards. You are especially at-risk of running up large bills with the insane interest rates some have. In 2019, a consumer debt study by Experian found that credit card debt was at an all-time high of $829 BILLION.

If you get one, be responsible.

Take care of credit card bills on-time and only use the card for expenses when you know for sure you can pay them back within a few weeks.

Prediction 4: Can A College Student Get Section 8 Housing

A standard college student whose parents cut them off from money probably can’t get Section 8 Housing. The following will qualify you out from getting it:

- Being enrolled as a student at an institution of higher education

- Being under the age of 24

- Not a veteran of the U.S. Military

- Being unmarried

- Not having any dependent children

- Not a person with disabilities

The full requirements to actually get it and some more detail on being qualified out can be found on the U.S. Department of Housing and Urban Development’s Website here.

Search Prediction 5: Can A College Student Get Unemployment

Surprisingly, the answer to this search prediction here is “maybe.” You might think that being a full-time student would prevent someone from receiving unemployment for the obvious reason that most students can’t hold a full-time job. However, students who would normally have part-time jobs or had job offers can get unemployment now.

Coronavirus relief to the rescue

Through the end of December 2020, students can get about $190 of unemployment benefits through the coronavirus relief fund. Anyone who had a job affected by the coronavirus is eligible to apply. Think restaurant workers, cashiers in stores that closed down, and anyone who had their employment stopped because of the pandemic.

Prediction 6: Can A College Student Get EBT

We’re skipping those other search predictions because they repeat earlier ones. EBT falls into the category of food stamps, but it is different enough to dig into. EBT stands for “electronic benefits transfer” and is an electronic system that allows people to use their government benefits at various retailers for food and other products related to a family’s welfare.

Students are out of luck

For the same reasons most average college-aged students don’t qualify for food stamps, most wouldn’t qualify for an EBT card.

Tying It All Together

Yes, being in college can be a grind on the finances. The student loan debt has now topped 1.6 trillion and will continue to grow during our current pandemic. Right now, you have the benefit of not needing to make those pesky student loan payments or think about whether you should refinance if you’ve graduated. If you do need to find some extra green in school but lost your job, consider the different ways to make money online that are out there like freelance writing or the various survey sites that pay for your opinion.