Title IV Schools – Complete List And Their Importance

Title IV: What is it and why is it important to you? Title iv schools are an important part of the higher education system.

Advertiser Disclosure: We receive compensation if you sign up for products or services mentioned in this article. For more info on that, click here.

List last updated August 2024

The video below will explain why Title IV is important to understand:

Title IV and Financial Aid

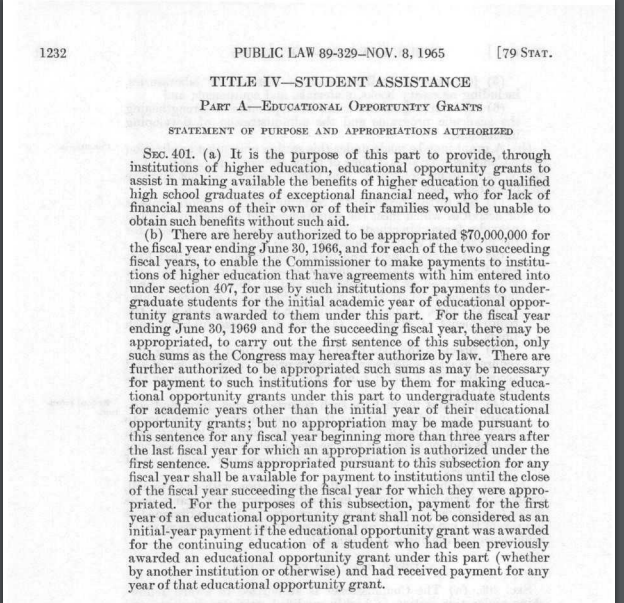

Title IV (Title four) was one of the eight different titles in the Higher Education Act of 1965, a law designed “to strengthen the education resources of our colleges and universities and to provide financial assistance for students in post-secondary and higher education.”

It specifically covers financial assistance. Many schools out there have the designation and their own policies around the use of those funds, too. Most private student loan and refinancing companies require that your loans are from attending a school that is title iv.

2024-2025 Federal School Code List

Data from the Federal Student Aid office.

View It As A Spreadsheet:

Click To View the Title IV School List

Open it in Excel or another spreadsheet program like Apple Numbers, Google Docs, or OpenOffice.

View It As A PDF:

Click To View the Title IV School List

*Note from FederalStudentAid:

“The Department of Education strives to make all content accessible to everyone. While these documents do not currently meet the standards of Section 508 of the Rehabilitation Act of 1973, as amended, Federal Student Aid is working to create accessible versions. If you need access to these documents before the accessible versions are available, please contact the Information Technology Accessibility Program Help Desk at [email protected] to help facilitate.“

Now Check Your Personal Loan Rate with SoFi

Which Funds Come From Title IV?

These are funds that come from different federal student aid programs. They include Pell Grants, Direct subsidized or unsubsidized loans, Direct Plus loans, Direct Graduate Plus loans, and Federal Supplemental Educational Opportunity Grants (FSEOG).

In order to find out if you qualify for the funds, you need to fill out the Free Application for Federal Student Aid (FAFSA). You’re probably in the middle of that right now if you’re looking at these school codes.

Where the Funds Can Be Used

There are typically three places where you can use the funds once received. They can be applied to tuition, mandatory fees, and room/board if housing is contracted through the college or university you attend.

Some of those mandatory fees may include counseling fees, library fees, or lab fees associated with specific courses. Remember, if you live off-campus in a fun college house – rent isn’t covered by this money! Think twice before rushing off-campus after Freshman year, because your wallet will thank you.

Using Title IV Funds Elsewhere

While you are initially instructed to use this money for the types of things mentioned above, it is possible to authorize your school to let you use Title IV funds outside of those charges. Non-authorized charges include things like parking, some healthcare expenses, and previous semesters’ balances on your student account.

Most schools will either have a form to fill out or an electronic authorization accessible through your student account (the same place where loan information is). Look for something that says “Title IV Financial Aid Waiver” or “Title IV Authorization Form.”

*thiscollegelife.com is not affiliated with the Department of Education or FederalStudentAid office